Is your understanding of San Mateo County property tax a complete one? Navigating the complexities of property taxes in San Mateo County, California, is a crucial endeavor for homeowners, investors, and anyone with real estate holdings within the region. The intricate system, governed by a combination of state and local laws, demands careful consideration. From understanding assessments to appealing valuations and anticipating the impact of Proposition 13, a clear grasp of the intricacies is essential for financial planning and avoiding costly surprises.

The San Mateo County property tax system, like many in California, is multifaceted. The property tax is a significant source of revenue for the county and its various taxing entities, which include cities, school districts, special districts (such as fire protection and water), and the county itself. These funds are vital for providing essential services to the residents of San Mateo County. Property taxes are determined annually, and property owners receive a tax bill based on the assessed value of their property.

Central to the understanding of the property tax system is the concept of assessed value. Under California law, specifically Proposition 13, the assessed value of a property is typically its value as of March 1, 1975, or its value at the time of a subsequent sale or new construction. The assessed value can increase annually, but the increase is limited to a maximum of 2% per year, plus the value of any new construction or improvements. This limitation on annual increases can, over time, create a significant disparity between the assessed value and the fair market value of a property.

The county assessor is responsible for determining the assessed value of all taxable real property within the county. This involves regular property assessments, which may include on-site inspections, review of sales data, and consideration of other relevant factors. The assessors office strives to ensure fair and accurate valuations, but property owners have the right to appeal their assessment if they believe it is incorrect.

The property tax bill is calculated by multiplying the assessed value by the combined tax rate. The tax rate is the sum of the rates levied by all the taxing entities that have jurisdiction over the property. These rates vary depending on the location of the property within the county. The tax rate is expressed as a percentage of the assessed value.

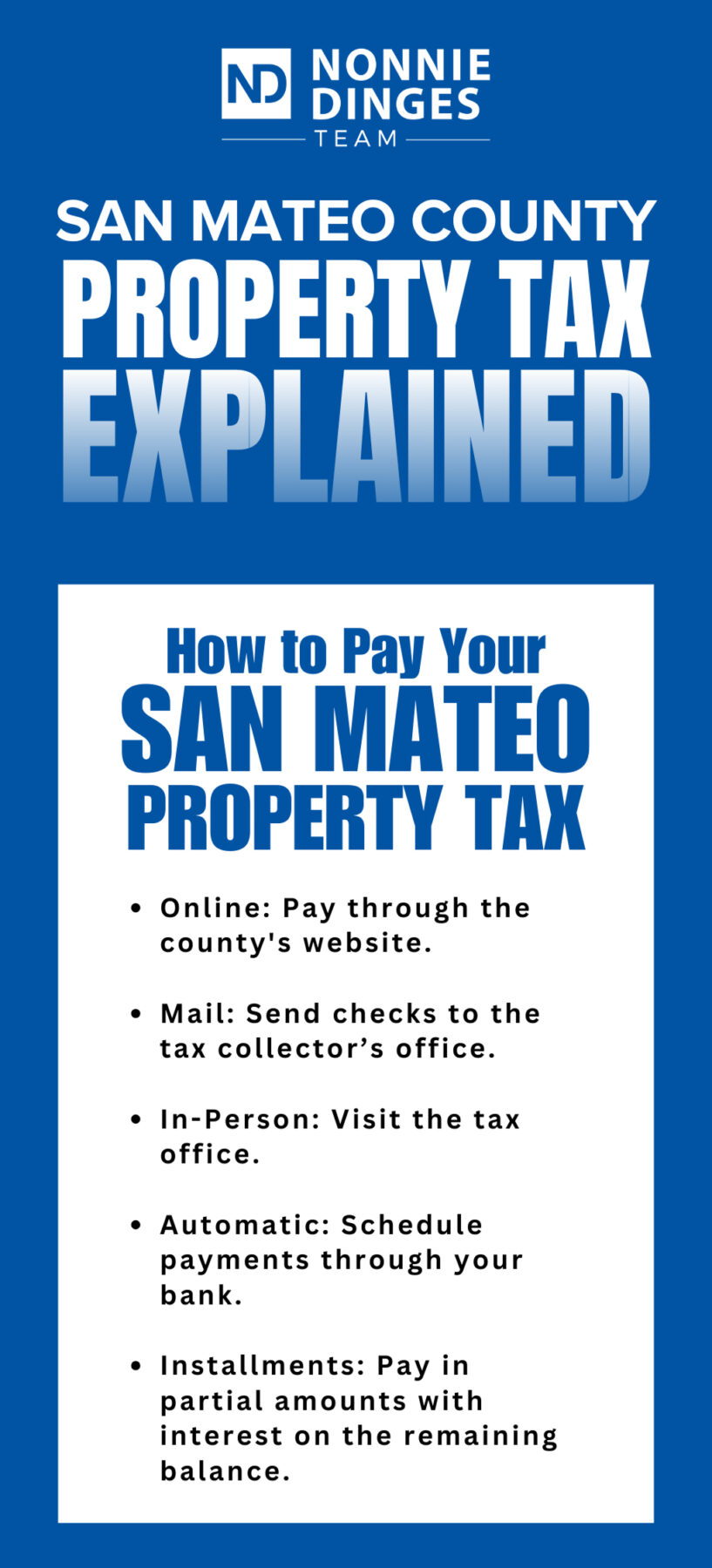

Tax bills are typically issued twice a year, with the first installment due in November and the second installment due in February. Late payments incur penalties, so it's important for property owners to be aware of the deadlines. The county offers various ways to pay, including online payments, mail-in payments, and in-person payments at the county tax collector's office.

Understanding the various exemptions and deductions available can significantly reduce property tax liability. Homeowners can claim the homeowner's exemption, which reduces the assessed value by a certain amount, resulting in a lower tax bill. Other exemptions may be available for veterans, disabled persons, and other specific circumstances. Understanding these provisions is essential to avoid paying more in taxes than you should.

Property owners have the right to appeal their assessed value if they believe it is too high. The appeal process generally involves filing an application with the county assessment appeals board and presenting evidence to support the claim. This can involve professional appraisals, sales data of comparable properties, and documentation of any property damage or other factors that might affect the value. Successfully appealing an assessment can result in a lower property tax bill.

The process begins with the county assessor determining the assessed value of the property. This is based on various factors, including the property's characteristics, location, and recent sales data. The assessor typically sends a notice of assessed value to the property owner.

If the property owner disagrees with the assessed value, they can file an appeal with the county assessment appeals board. The appeal must be filed within a specific timeframe, which is usually specified in the notice of assessed value.

The appeals board reviews the appeal and considers evidence presented by the property owner and the assessor's office. This evidence can include appraisals, sales data, and other relevant information. The board may hold a hearing to allow both parties to present their case.

After reviewing the evidence, the appeals board makes a decision on the assessed value. The board can either uphold the assessor's value, reduce the value, or, in some cases, increase the value. The board's decision is typically final, although there may be limited options for further appeal.

It is important to understand the impact of Proposition 13 on San Mateo County property taxes. Proposition 13, passed in 1978, significantly altered California's property tax system. It limited the assessed value of a property to its 1975 value or its value at the time of a sale or new construction. It also limited annual increases in assessed value to 2% per year. These provisions have resulted in a complex system where properties with similar market values may have significantly different assessed values, depending on when they were last sold or improved.

The information provided in this article is for informational purposes only and not intended as financial advice. It is always best to consult with a qualified professional regarding your specific situation.

Understanding the intricacies of the property tax system and staying informed of any changes can help property owners effectively manage their property tax obligations and ensure that they are not overpaying. Consulting with qualified tax professionals and staying up-to-date on developments in property tax laws is essential for informed decision-making.

The property tax cycle in San Mateo County is an annual process with distinct stages. It starts with the assessment of property values by the County Assessor, typically occurring in January. The assessor considers various factors, including property characteristics, market data, and any improvements. Tax bills are then generated and sent to property owners. The tax year runs from July 1st to June 30th. Payment deadlines are generally November 1st for the first installment and February 1st for the second installment.

Several factors can affect the value of a property and, consequently, the amount of property tax owed. These include improvements to the property, changes in market conditions, and any new construction in the area. In addition, the assessment process is subject to certain rules and regulations, such as Proposition 13. If a property owner believes their assessment is inaccurate, they have the right to appeal it, as described above. The appeals process involves the Assessment Appeals Board, which reviews the evidence and makes a determination.

Keeping up-to-date with current property tax rates and regulations is crucial for property owners. The San Mateo County Assessor's Office website provides essential information. Regularly reviewing this information helps property owners understand how their property taxes are calculated, find relevant forms, and access resources that can assist them with questions or concerns. Also, regularly consulting local news and financial publications will help you stay informed about changes to property tax laws and regulations.

The County Assessor plays a key role in property tax administration in San Mateo County. This office determines the assessed value of all taxable real property within the county. This office maintains a database of property characteristics, sales information, and assessment history. The assessor's office employs various methods, including on-site inspections, review of sales data, and consideration of other relevant factors, to conduct property assessments. The office is committed to fair and accurate valuations.

Property tax revenues provide critical funding for many public services in San Mateo County. These include public schools, community colleges, public safety, libraries, parks and recreation, and general county services. The allocation of property tax revenues is determined by state law and local agreements. Property taxes are essential for funding vital services that support the well-being of the county's residents and economy.

The process for appealing a property tax assessment in San Mateo County is well-defined and provides property owners with an avenue for contesting the assessed value of their property. To begin the process, a property owner must first file an application with the Assessment Appeals Board within the specified timeframe, typically detailed on their assessment notice. The application should clearly state the reasons for the appeal, providing any supporting documentation such as appraisals, sales data, or evidence of property damage. The Assessment Appeals Board then reviews the appeal, and may request additional information or hold a hearing where the property owner and the County Assessor can present their cases. The board ultimately makes a decision based on the evidence presented.

Delinquent property taxes can have serious consequences. If property taxes are not paid on time, penalties are assessed. If the delinquency continues, the county can initiate a tax sale, where the property is sold to recover the unpaid taxes. Additionally, delinquent taxes can affect a property owner's credit rating and ability to secure financing. The best practice is to pay property taxes on time. Paying on time also avoids penalties and the potential loss of the property.

The San Mateo County Assessor's office also has responsibilities that extend beyond assessment. The office processes property transfers, maintains property records, and provides information to the public. The office handles various aspects of real estate taxation and provides essential services to the public, including assessment, record maintenance, and information provision. This office ensures transparency and accuracy in the assessment process.

Exemptions and deductions are crucial for reducing property tax liability for eligible property owners in San Mateo County. Homeowners can claim the homeowner's exemption, which reduces the assessed value by a certain amount, leading to a lower tax bill. Veterans, disabled persons, and other qualifying individuals may also be eligible for additional exemptions. Checking eligibility for these exemptions and applying for them can significantly reduce property tax obligations.

Property taxes in San Mateo County are affected by changes in property values, tax rates, and the passage of state laws. The county's property tax rates are subject to change, depending on the needs of the local government and the revenue requirements of the taxing entities. Significant changes in property values, such as those resulting from significant market fluctuations, can also impact property tax bills. Recent legislative changes, such as amendments to Proposition 13, can also change property tax laws and affect property taxes.

Understanding the different types of property tax levies is important. General property taxes are the standard taxes levied on all taxable property. Special assessments are charges for specific local services, such as street improvements or fire protection. Mello-Roos taxes are special taxes levied to finance specific public improvements or services in designated areas. The type of tax levied on a property will affect the overall property tax bill.

The San Mateo County property tax system is a complex one, impacted by various factors. Key aspects include the assessed value of the property, the tax rate, and any applicable exemptions or deductions. Understanding these aspects is important for navigating the system. The county assessor is responsible for determining the assessed value of all taxable real property within the county. The tax rate is a combination of rates levied by all the taxing entities that have jurisdiction over the property. Exemptions and deductions are available for eligible property owners.

Staying informed is key. For up-to-date information on property taxes in San Mateo County, it is best to visit the official website of the San Mateo County Assessor-County Clerk-Recorder's Office. The site provides resources, forms, and information to assist property owners. This office ensures that information is always accurate and easy to access. Also, consult with qualified tax professionals for specific guidance regarding your situation.

The valuation of property is not static. The assessor must consider various factors when assessing property values. The market conditions will determine how to value the properties. Changes in market conditions, such as fluctuations in real estate prices and interest rates, can impact property values and therefore property tax bills. Also, the assessment process includes the review of sales data. Property owners should review the property valuation annually, as it might fluctuate yearly.

Property tax planning is an important aspect of financial management for property owners. This planning involves several strategies. Taxpayers should understand the property tax rules and regulations. They should consider property tax implications before making real estate investments and consider the effects of any property improvements. These strategies can help property owners minimize their property tax obligations. Consulting a tax advisor is recommended.

It's imperative to be aware of the potential pitfalls. Inaccurate property assessments, late payment penalties, and the failure to claim applicable exemptions can result in overpaying property taxes. Additionally, a lack of understanding of property tax laws and regulations can lead to unintended consequences. Staying informed, filing appeals when necessary, and seeking professional advice can help property owners avoid these pitfalls.

Finally, it is crucial to recognize that property taxes are essential to our community. Property taxes fund various community services. Property taxes provide essential public services for the residents of San Mateo County, which is vital for the community's growth and quality of life. Understanding the role property taxes play ensures that a community understands the importance of their role in supporting essential services.

Disclaimer: This article provides general information only and should not be considered tax or legal advice. Consult with a qualified professional for personalized guidance.

| Aspect | Details |

|---|---|

| Governing Body | San Mateo County Assessor-County Clerk-Recorder's Office |

| Tax Rate Components | County, Cities, School Districts, Special Districts |

| Assessment Basis | Generally, 1975 value or value at time of sale/new construction (Proposition 13) |

| Annual Increase Cap | 2% (plus improvements) |

| Assessment Appeals | Allowed; file with Assessment Appeals Board |

| Tax Bill Frequency | Twice a year |

| Payment Deadlines | 1st Installment: November 1st, 2nd Installment: February 1st |

| Exemptions/Deductions | Homeowner's, veterans, disabled (check with the Assessor's Office for all available exemptions) |

| Key Legislation | Proposition 13 |

| Primary Website | San Mateo County Assessor-County Clerk-Recorder's Office |